The Jobless Rate Could Fall to 4.7 Percent by the End of 2015

By Peter Coy

November 05, 2014 - Businessweek

If current trends continue, the U.S. unemployment rate could get down to 4.7

percent by the end of next year—low enough that labor shortages could begin to

drive wages up too rapidly and cause inflation, concludes an analysis by a Wall

Street economist.

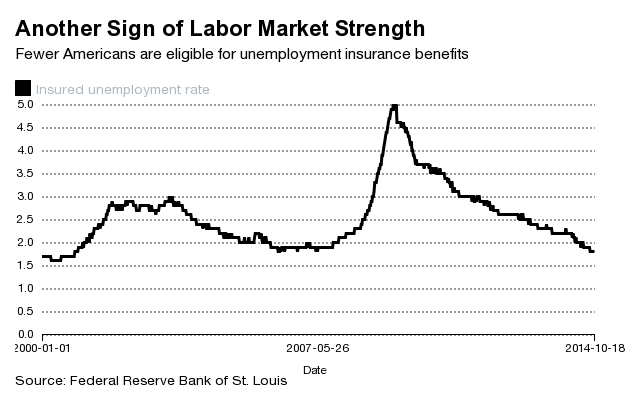

Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities, cited

whatfs known as the insured unemployment rate, which he said is a leading

indicator of the ordinary unemployment rate. In other words, when the insured

rate changes, you can be pretty sure the ordinary rate will change soon

after—and in the same direction.

The insured rate is the share of the labor force thatfs eligible to receive

unemployment insurance. Itfs lower than the ordinary unemployment rate, which is

the share of the labor force thatfs out of work and actively seeking a job. The

insured rate peaked at 4.9 percent in May-June 2009; four months later, the

ordinary unemployment rate peaked at 10 percent. The insured rate has since

fallen to only 1.8 percent, compared to 5.9 percent for the ordinary

unemployment rate in September. The last time the insured unemployment rate was

this low, the ordinary unemployment rate was just 4.6 percent.

gOur best guess is that as the unemployment rate trends lower over the next

couple of quarters, wage pressures will begin to trend noticeably higher,h

LaVorgna wrote in a note to clients. gIn turn, this will provide the impetus for

a liftoff in the fed funds rate around the middle of next year.h